A business advisor is a profession or service who focus on different types of strategy and implement it for the success and growth of the business. Business advisors provide expert advice in a particular area of business.

If you are a foreign investor, you must take advisory service before company registration.

The advisory service will help you save time and money. However, almost all foreign investors contact us to register a company within Malaysia. Most of the foreign investor who wants to register their company without any advisors face many difficulties.

For example: once you get the business license, you probably think you can open bank account easily, but in most cases bank refuse to open an account. No consultancy service can provide grantee to open a bank account. In this circumstance, the foreign investor falls into deep trouble.

We got many similar cases, where foreign investor visits Malaysia and contact with an expert to get the business license. But at last, they fail to open a bank account.

Most of the people who think they are expert, but they don’t know the reason behind this failure. However, we know some particular cause behind of failure.

So, if you want to register your company in Malaysia without any harassment, contact us. Our guideline will definitely make you happy.

We grantee to prepare you all the legal documents to setup your business. Take free advisory service before you register your company and save your valuable time and money.

Business might be set up by any amount (Ringgit 2000 to 3000) if the shareholders are 100 % foreigners or joint venture. Ringgit 350,000 is required in terms of starting a Joint Venture and if professional visa or work permit visa.

As immigration law, if foreign directors/ shareholders/ staffs like to live in Malaysia, then you need to show the necessary capital of Ringgit 500,000 to 1 million (100 % foreign ownership company).

We suggest SDN BHD (Private Limited) company to registers as a foreign-owned company. Sole Proprietorship company registration Malaysia is not allowed for the foreigners. We can say, almost all foreign business is registered as SDN BHD format in Malaysia.

It usually takes around 4 to 5 five days business days to complete the process of company registration (includes name approval and company incorporation).

The type of license requirement depends on the kind of business. For example, if you want to start a restaurant business, you need Halal license, SOCSO, etc. But the license is not required you start an export or import business. In this section, we will discuss various types of license that you need to incorporate a company in Malaysia.

If a company have more than 50% foreign ownership, needs WRT license to participate in, franchise, retail, trading, restaurant, import and export businesses. According to the policy of “Ministry of Trade,” you need to have office space of your company, you need to have an exact point of business activity. If you have all this, getting WRT license will not be a problem. It is good to equip your premise before applying for WRT license. Some important details of WRT license are noted below: -

SOCSO know as Social Security Organization was established back in 1971 under the ministry of HR (known as the ministry of labour). It was established for providing the social security protection for the employee/ workers of Malaysia (75 per cent will be contributed by the employer and .5% will be contributed from employees, age limitation below 60 years). The function of SOCSO are given below: -

Only the company incorporation document is not enough for starting a business in Malaysia; you also need a signboard license. The requirement of signboard license is described below:-

EPF is known as Employees Provident Fund- EPF is a policy for the benefit of employees after retirement from service. EPF is a government-managed retirement savings scheme, which is used to provide the retirement benefits to the employee and employer.

The employer contributes 13%, and the employee contributes 8% of their salary upon some conditions. It requires 2 to 7 days to get insurance coverage. However, the employee provident fund may vary upon your income. For example, an employed Malaysian who are aged below 55 and earns RM10,000 a month: -

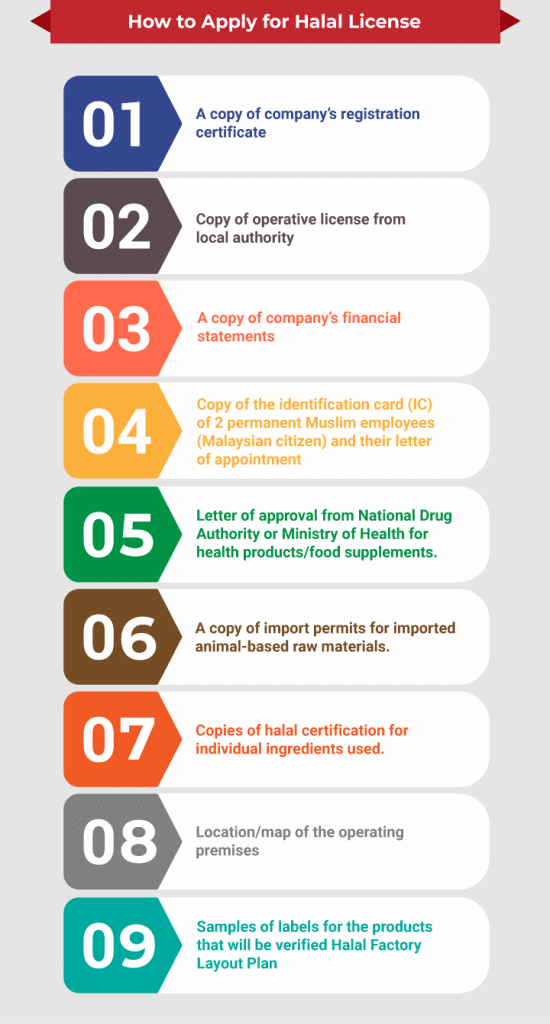

The following business category needs to apply for Halal License: (1) Distributor (2) Manufacturer/ producer (3) Repacking (4) Food premise (5) Slaughterhouse business (6) Packing material etc. The process of applying for a halal license is shown in the infographic below: -

Registering export and import license is a complicated process. Though it’s a complicated process, many foreign investors want to register a company on hope to start an export & import business.

To get this license, first of all, you need to decide which port you will use for your business. However, there are mainly three government bodies which are responsible for issuing export & import license. The steps of export & and import license are given belwo—

To register the export & import license, it will cost you a minimum of Ringgit 4500 to 5000. The cost includes government fees, transport, and advisor. It takes around 30 days to receive to receive certified copies or permission.

| Professional advisory fees | Ringgit 2500 |

| Government fees and Secretary Fees | Ringgit 1200 + 100 per month |

| sign board, business license, export & import, SOCSO, EPF, Professional visa work permit | Ringgit 20,000 |

We work for the foreigners to manage all above licenses as our responsibilities, in a professional manner. For company registration, you need to move from one place to another, which is time-consuming.

However, if you come to us, we will offer you a package which includes everything from obtaining permission from the government registering your company.

In this section we will discuss on some necessary Act of company registration in Malaysia. The table below shows details –

| Section 14– registration of a company | At least two shareholders are required to form SDN BHD companyA new modification of rule, one shareholder might allow registering a new company in Malaysia. |

| Section 15-Private Limited Company | Share can’t sell in public market being private limited company unless convert into public limited company. |

| Section 143 – Annual General Meeting | Every company shall hold an annual general meeting within 18th month from the date of incorporation. |

| Section 21- Winding Up Company | Every company has the right to wind up business after confirmation clearance of taxation and permission of the court. |

There is a demand for highly qualified professionals in various industrial and business sectors. This is why Malaysia starts granting work permit visas to eligible people.

The type of work that passes visa depends on the kind of work and skills. Malaysia offers three types of work permit visas such as employment pass, professional visit pass, and temporary work pass.

Work permits are allowed only to persons with specific skills. In some cases, they must have specialist knowledge to work in the technical and managerial position.

The employment contract is issued for a minimum of two years. Before requesting this pass, you must have a valid passport, and it must have an expiry period of at least 18 months.

The temporary work permit visa is usually issued for an employee or worker who will work in the company for less than 2 or 3 years. The temporary work visa is also applicable for an employee who receives a salary of less than RM5,000 (no dependents allowed).

This visa is issued when a Malaysian company requires a particular service from the employee or the worker for a period of up to 6 months. The visa for the professional visit does not need age limits to enter Malaysia as a foreign worker (dependents are allowed).

For profession pass, it requires 6 to 7 weeks to get the result. If you are rejected for the visa with cause, you have the chance to review the papers and correct it.

However, to apply for a professional visa, you may require RM 10,000. The validity of professional pass stays for 12 months to 24 months. On the other hand, the professional visit pass stays for six months.

There are many problems to register a business in Malaysia as a foreigner. Some of the problems are pointed out below –

There are various cost of setting up business such as- trademark registration, signboard license, advisor fee, company MyCoID website development etc. Beside this, there are other costs for setting up business such as –

According to the 2016 corporate act, all foreign companies must have at least one local director (should be a Malaysian citizen). There is highly qualified and knowledgeable staff in Malaysia who can be appointed nominee director.

Many consultancy centers can help you to rile a reliable and trustworthy nominee director. The condition of nominee director points out below–

Q: How can I register my company without being present in Malaysia?

Q: Which one is better, Labuan Company of SDN BHD Company?

Q: How do I export & import in Malaysia from India, Bangladesh, Thailand and Singapore?

Q: How much actual cost of company registration in Malaysia (government fees)?