Accounting services in Malaysia

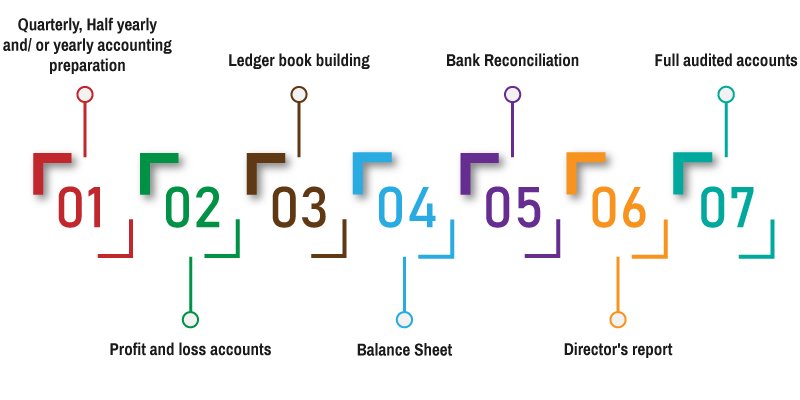

| Accounting services Malaysia | Particulars |

| Audited Accounts | Quarterly, Half-yearly and/ or yearly accounting preparation |

| P/L | Profit and loss accounts |

| Ledger | Ledger book building |

| B/S | Balance Sheet |

Accounts in Malaysia as Section

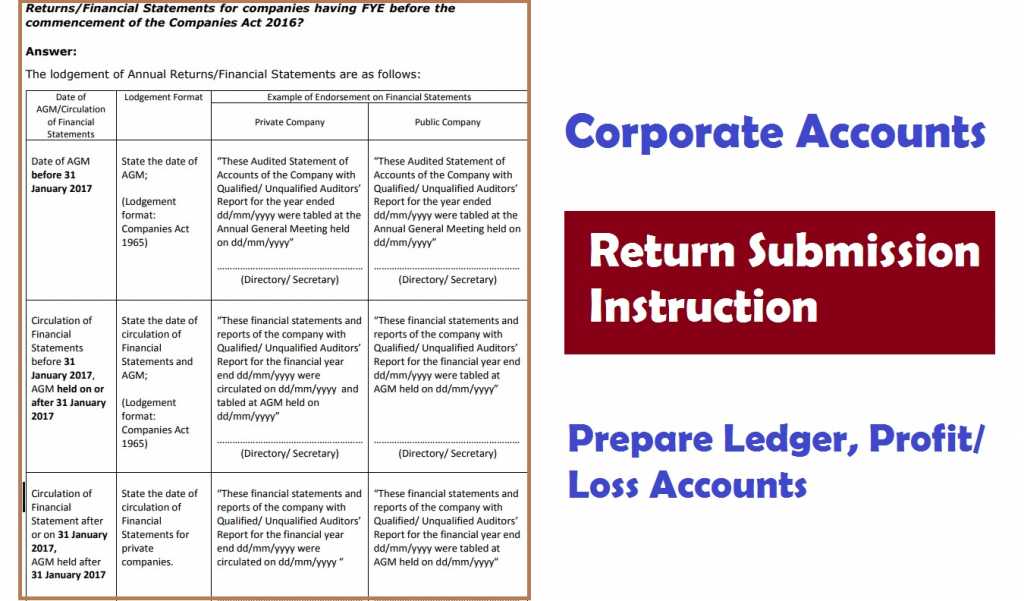

| Section of CA | Particulars | Particulars |

| 167 | Every private limited company, shares holders, the manager will maintain accounts record | Corporate accounting will be prepared to maintain the standard |

| 169 | Accounts report shall be presented before the meeting of AGM | 1st AGM will be completed by 18 months from incorporation date and after then by every calendar year and not more than 15 months |

| Profit and loss, B/S, directors report, auditor’s report, notes, and statement | The audited accounts shall be certified by the directors or Company Secretary | |

| 141 | Within one month from incorporation, each entity will lodge a return to Register about directors, secretaries, and managers of the company |

Filling form 49 all data shall be updated if any changes are made within 30 days of changes. |

Balance Sheet

| Current Assets | Current Liabilities |

| Net Current Assets | Equity and liabilities |

| Retained Earnings | Total Equity |

Bookkeeping services Malaysia

General Ledger Sample

| Share capital | Retained Earnings |

| Cash in bank | Accruals |

| Amount due to director | Advertisement |

| Bank charges | Secretary |

| Printing | Trade & accommodation |

| Fixed Assets | Audit, professional, bookkeeping services, audit, tax, and other fees |

Profit and Loss accounts

| Net Sales | Gross profit |

| Expenses | Net profit after tax |

| Others | Retained earnings |

Accounting services in Malaysia

Accounting services Malaysia

As accounting services in Malaysia, we prepare professional accounts with a low budget. We have noticed that every year May, June, and July are very busy times for the accountants and auditors and prices become higher in this period than other times. Auditors sometimes prepare accounts for their clients at a high price. Our plan is to give customers satisfaction as well as maintain the standard of accounting services Malaysia.

Actually, accounting fees depend upon the volume of transactions and numbers of invoices. However, we offer standard accounting service prices at RM 800, 1000 to above, not more than RM 3000 (at maximum in case of huge transaction and volume is higher) for the corporate. Our offer will save you money and time. It’s our commitment to deliver the complete accounts within the time frame. Our team member will prepare a ledger from your supporting documents. If the customer likes to get accounts to report monthly basis and/ or quarterly basis will be provided the same. You may want to know about What is Sdn Bhd? Sendirian Berhad in Malaysia.

You are worried about hiring an accountant for your company! There may not be hired accounts staff (s) in small and medium enterprises some reasons:-

| Fees | Number of transactions (yearly) | Volume base on a yearly (Ringgit) |

| 500 | 10-50 | Less than 500000 |

| 800 | 20-70 | Less than RM 500000 |

| 1000 | 30-100 | 500000-600000 |

| 1500 | 50-150 | 500000-700000 |

| 2000 | 80-2000 | 500000-800000 |

| 3000 | 100-3000 | 5000000- 1 Million |

| 4000-5000 | 5000-6000 | Above 1 million |

Accounting services in Malaysia

Freelance accounting services are required mostly for SME companies to prepare monthly, quarterly and annually financial statement. Freelance accountant work as part time basis considering both parties winning situation.

Chartered Accountant (M) members and experienced accountants are working from home to prepare complete bookkeeping by low budget. CA (M) those are listing members of MIA are preferred to engage in accounting services.

Why shall I go to accounting services as I have accounts software?

To update daily transactions in software it requires a professional person. The software might not easier to use and there has a chance of data missing to update regularly.

How much accounting services fees in Malaysia?

Audit firm will charge higher than average and very formalities. Our fees are RM 800, 1000 and maximum RM 3000 for large companies and huge transactions.

Why your firm is different than others?

We prepare accounts by the Chartered Accountants and/ or Cost and Management accountants who are experienced in this field and qualified member (s).

How can you provide accounting service monthly basis?

Our team member (s) will visit your office every month to collect data and invoices and will be updated regular basis.

How can I get accounting report staying abroad?

As accounting report will be prepared monthly basis and will be sent via email to have a check from abroad.

Why should I hire your firm to prepare our company accounts?

Let one accountant be hired by RM 2000-3000 monthly salary basis that stands RM 24000-36000 whereas you are getting better accounting services in Malaysia, Kuala Lumpur, Selangor, Penang, Johor Bahru, any place by cheaper as our plan of lower rate accounting services fees in Malaysia and hassle-free.

Address: A-03-13 Tropicana Avenue, No 12 Persiaran Tropicana, Tropicana Golf & Country Resort PJU3, 47410 Petaling Jaya, Selangor, Malaysia