Malaysia is one of the largest export economies in the world. It is not easier to know real information about how to open a company in Malaysia as foreigners? Currently, it ranks 18th in another country. A recent report shows that it has shipped over 189 billion worth of goods in 2016.

Contact us over direct call or WhatsApp: +601151177141

Requirements to open Sdn Bhd companies are as follows:

https://youtu.be/igGUuHXiYhw

Malaysia’s top three export minerals are minerals fuels, computers and telephone and electrical equipment. Because of its resources and steady economic growth, Malaysia now attracts a huge amount of foreign investors. Malaysia has now become the central hub for starting a business in East Asia. This article is going to describe- what kind of business you should start in Malaysia, document preparation for the business license, and the cost of registering other necessary business-related licenses.

First of all, you need to find out what types of business is permitted in Malaysia for foreigners. Before you think of open a company in Malaysia, you need to remember that as a foreigner you are not encouraged to set up a business or apply for jobs in specific government sector. Such as textile, minerals or food industry. However, the Malaysian governments encourage foreigners to start a business in the manufacturing and service sectors.

The service sector is considering as one of the important sectors for the economic growth of the country. It is expected that the service sector (financial service, retail trade, communication subsectors) will grow at 6.8 per cent per year. That means it will contribute more than 50 % to the GDP by 2020 and create over 9 million new jobs. Recognizing the potential of the service sector, the government of Malaysia liberalize more than 25 subsectors back in 2009 to bring more foreign investment in the country.

Read Also : Check company registration Malaysia

Three Most Common Types of Business a Foreigners wants to start in Malaysia

A foreigner can start a business in manufacturing or in service sectors without any restriction. In this section, I will discuss three most common types of business for foreigner’s in Malaysia

Depending on the types of business foreigners are allowed to register a Sendirian Berhan with 100% ownership. However, the Malaysian “Investment Development Authority” maintains all the details record of business that is open to foreign investment in the country. At least 2 members (Director) of the company should have a permanent resident in Malaysia. The private limited company needs to have an employee between 2 to 50 members and 2 shareholders.

Labuan companies are allowed to rent properties in Malaysian but they are not allowed to sell anything in Malaysia. So Labuan company are unsuitable for local business in Malaysia, as they cannot sell to the Malaysian customer. However, entrepreneurs who want to establish a financial service or international trading business can set up a Labuan company. Labuan is also beneficial for regional distribution businesses, as it is exempt from import and export duties in Labuan. The benefit to open a company in Malaysia especially in Labuan is almost income tax-free.

The representative office is a convenient way to explore the Malaysian market. This business entity is not subject to corporate tax, but it does not generate profits, so it does not involve any commercial, business or commercial activity. Instead, it may be used to support the head office in support of market research and product support, such as product development, planning or coordination, post-production, and post-sales support.

However, beside this business there are some other types of business such as consulting farm, partnership company, free zone company etc.

Read Also: The sales and service tax (SST) in Malaysia

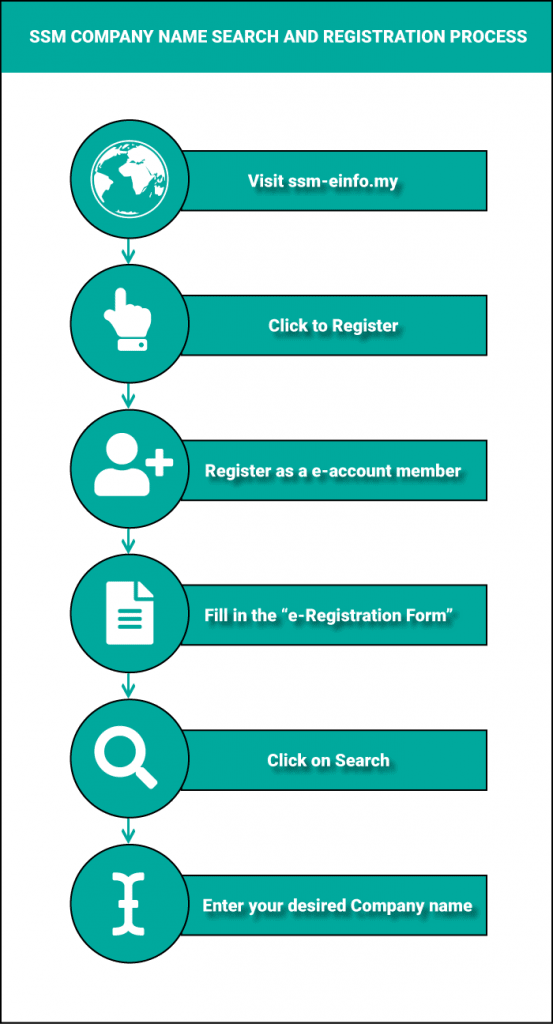

This portion of the article will guide you for completing the official forms to register a business or company. All you need to do is to follow some simple steps for completing the entire process of registration. First of all, you need to check the availability of the company name (Through name Search at www.ssm-einfo.my). After that, you need to complete” BORANG PNA 42” and BORANG A forms for completing trade name and company registration.

After completing all these works you go to SSM head office for submitting the forms (bring RM70 & ID Card) for completing the registration process. However, you can complete all of the above tasks online. All companies are registered upon submission by papers to SSM through online. If you don’t know the procedure you can hire a consultant or advisor. All files are submitted online to review. The infographic below shows company name search process steps by steps. Following steps will let you know the path about how to register a company in Malaysia as foreigner and local?

Registration and other license fee as follows: -

| Description of services | License | Fees |

| Company incorporation service, Opening bank account, buying forms from SSM, Secretary service 1-year, virtual office & professional fee | Incorporation | 3000 |

| Prepare supporting papers and apply for signboard and premise license | Signboard & Premise | 2000 |

| Prepare supporting papers and apply for export and import license | Export & Import | 4000 |

| Prepare supporting documents and apply for WRT license for non-residents | WRT | 4000 |

| Prepare supporting papers and apply for Kinder garden school license, Halal License and many more | Dagang.net | Fees vary (Contact us) |

| Add product and/ or brand name with company name permission | Notification | 1000 |

| Prepare supporting papers and apply for Trademark license. | Trade Mark | 5000 |

https://youtu.be/Kn21sAUciHs

First of all, find a company secretarial firm who has company secretary in house to guide opening a company in Malaysia. For setting up a business in Malaysia, you can expect to pay a registration fee to the business objects or entity that best suits the situation, given that each body has its own requirements and procedures.

You also need to provide enough for multiple commercial licenses, an office space, an initial bank deposit, tax and compliance and maintenance procedures. Follow steps to discuss:

Conclusion

In this article, I have described some factors for starting a business in Malaysia as a foreigner. Besides this, I have evaluated the entire process of foreign company registration (through online). However, this article is written for people who want to start a partnership business in Malaysia only. It’s not as complicated as you think of registering a business in Malaysia in. Even if you think you need help or advice about registering your company in Malaysia don’t forget to contact us. We are always here to help you out.