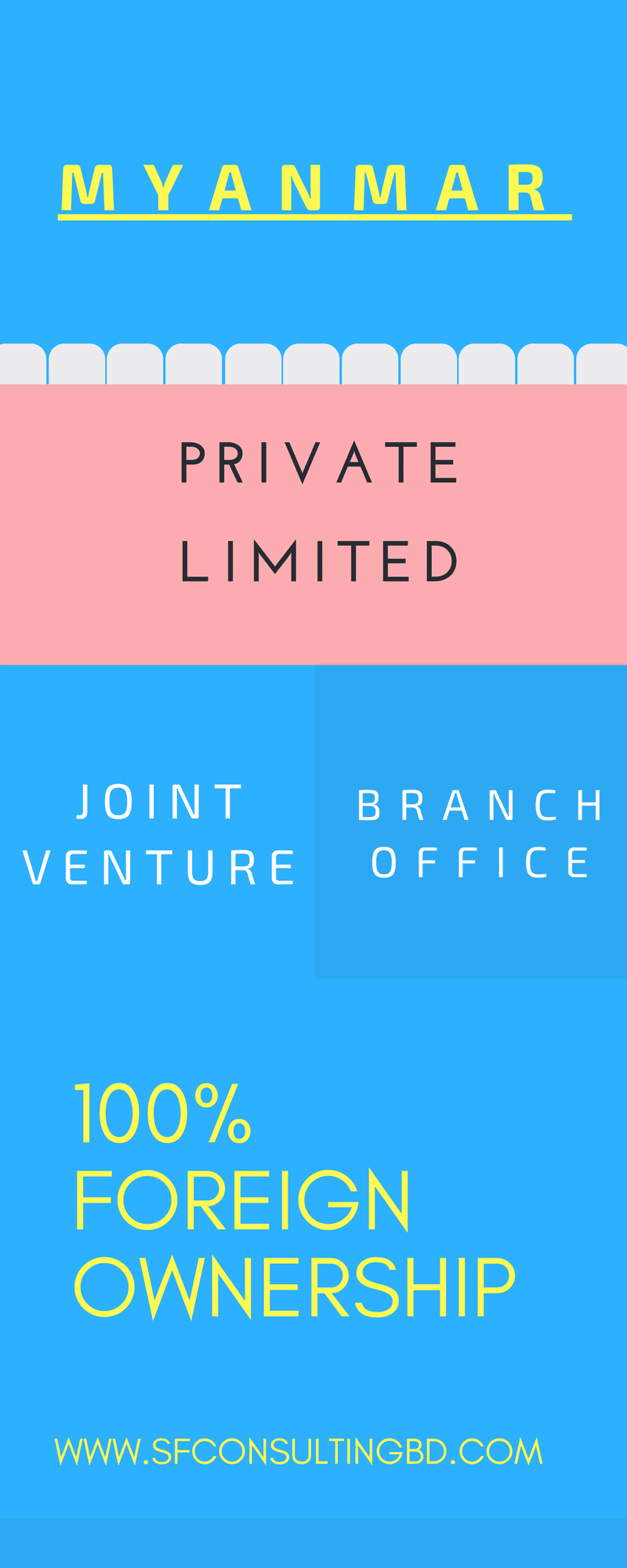

Myanmar Foreign Company Registration-Incorporation

Our service: Myanmar foreign company registration-incorporation services;

Company registration in Myanmar for foreigner (private limited company-LLC, branch office);

Accounts, income tax, audit and financial advisory;

Let discuss step by step of Myanmar foreign company registration-incorporation process:-

- Ensure corporation name being first job of incorporation , Address, MOA, Papers notary, Trade authorization, VAT (Value added tax) and other permission is required to doing foreign trading;

- Minimum two share holders are needful to create fresh a private limited corporation in Myanmar foreign company registration-incorporation policy;

- Without passport and photograph of the sponsors enterprise cannot be incorporated;

- Registering manufacture industry US Dollar one hundred fifty thousand remit sum need to show through bank statement;

- Provided that US Dollar fifty thousand cannot skip formation of a fresh limited service enterprise and/ or local office here, half amount of them shall be confirmed within a year and half at the time of registration;

- It cannot complete less than two months to incorporation in Myanmar;

Joint Venture Company in Myanmar

- Foreign sponsors cannot hold less than thirty five percent of total share, provided that the sum US Dollar five hundred thousand for the production industry and three hundred thousand for the services organization should remit;

- Starting such trading at beginning permission is granted for three years in Myanmar foreign company registration-incorporation as law of state;

Income Tax for the commerce organization

Tax holiday is allowed for three years upon consideration of MIC and type of trading;

- Property lease 30 years , renew after 15 years;

- Corporate tax is thirty five percent (%) as well as liaison office tax rate is same percent;

- Five percent (%) tax shall be applicable on sales of goods;

- Forty percent (%) tax shall be applied in case of capital gaining from trading;

- Another sensitive information is tax holiday for five years on manufacture corporation, provided that be said sum need to be ensured;

Required papers to set up liaison, branch office in Myanmar

- Submit application to DICA , first step, permission of such office;

- Permission of such office local possession is not required at all;

- Corporate tax thirty percent;

- Tax return submission annually like LLC is required here to show expenditure and income;

- Government approve begin liaison office upon receiving of sum US Dollar fifty thousand;

- There are different approval papers of the mother corporation with attested by embassy

- Meeting decision from sponsors ;

- Power given a human who shall proceed taking liabilities in favor of mother organization;

- About more a month (6 weeks ) might needful to complete registration process;

Representative Office open

Income tax is not applicable on such office and business ideas in Myanmar;

- Not for all business but for Banks and insurance corporations are allowed to open such office;

- No excuse to submit yearly income tax return to the authority;

S & F CONSULTING FIRM LIMITED

Email us: [email protected]

Naypyidaw, Yangunr, Myanmar