Private Limited Company is one of the most lucrative forms of business structures in Thailand. According to section 1096 of Civil & Commercial Code, a limited company should form with a capital that is divided in equal share. This form of business structure gains popularity due to its flexible features.

The following are the requirements for Incorporation of a Private Limited Company-

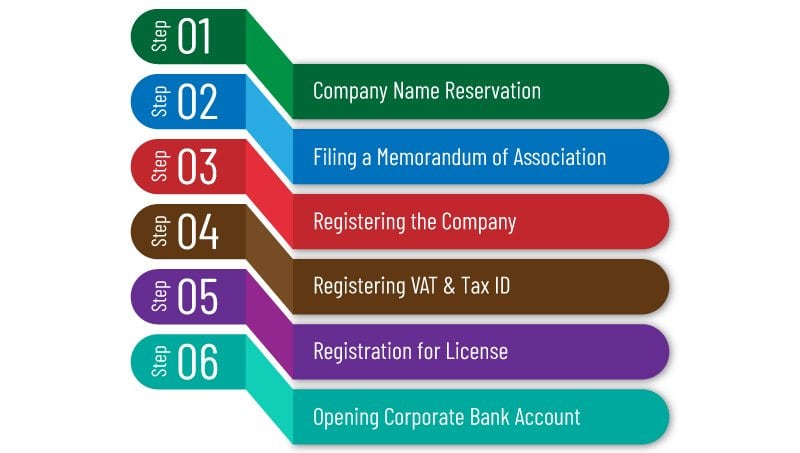

This is the first process of Private Limited Company Registration in Thailand. The requirements for company name registration are:

Once the name of the company is approved, now the applicant needs to prepare Memorandum of Association. The Memorandum of Association should include¬¬– the name of the company, details of all the shareholders, address of the registered office, the total amount of registered capital, and explain the process of company registration in Thailand.

The applicants need to submit the Memorandum of Association to the Ministry of Commerce. However, the registration of Memorandum of Association costs 500 baht for the registered capital of 100000 baht. The minimum registration fees for MoA ranges from 500 baht to maximum 25000 baht. However, the Share Certificate Insurance will cost 3000 baht and 1500 baht for company shareholders registration book.

The applicant must hold a statutory meeting, once the Ministry of Commerce reserves all the shared of the company. The applicant is required to pay at least 25% of the registered capital. Upon the verification, the Ministry of Commerce will issue the certificate of incorporation. Once you obtain an incorporation certificate, you can start your operation.

A private limited company must register for vat and Tax ID with 60 days of company incorporation. To register for vat and tax, it is required to submit an application to the Revenue Department. Once the company is registered for vat and tax, now the company needs to provide a monthly and yearly report to the revenue department. The report includes¬–

A private limited company in Thailand needs to obtain a specific business license for specific business objectives. There are various types of license, such as –food license, import/export license, e-commerce license, Alcohol license, and many others.

It is the last steps of private limited company registration. To open a corporate bank account, the company directors must be present at the time of account opening. The documents requirements for opening a bank account include–Passport and photographs of company shareholders.

| Types of fees | Fees in Baht |

| Company name registration | Free of costs |

| Company registration service fee | 17000 baht (registered capital below 5 million) |

| Company stamp | 500 baht |

| Vat and Tax registration | Free of costs |

| Government fees | 6500 baht for 1 million of registered capital 12000 baht for 2 million. |

| Filling Memorandum of Association | 500 baht for 1 million of registered capital |

Read Also: All of Company Registration Fee in Thailand

Almost all foreigners want to set up a private limited company rather than going for another company. Registering a private limited company in Thailand is a simple and straight forward if you know complete company registration procedures. However, most of the foreigners don’t know the process of company registration. As a result, they face many types of problems when trying to register by themselves.

It is recommended to contact with business consulting firm to ease the process of company registration. S & F consulting firm is one of the leading consulting firms that offer company registration service both in Thailand and aboard. Contact S & F Consulting firm for any business solution.

FAQ - Frequently Asked Question

Can US citizen own 100% foreign owned company in Thailand?

Only US citizen can own 100% foreign owned company in Thailand. Foreigners from another country are not allowed to open a 100% foreign owned company.

Which business is best in Thailand?

There are lots of profitable business in Thailand, among them real estate, tourism, and automobile business is the most popular and profitable in Thailand.

How much does it cost to register a private limited company in Thailand?

The costs for registering a private limited company depends on the total amount of registered capital. Contact us for details