Switzerland is well known as the heart of the global trade center. It is the most attractive countries for investors from around the world to do business. Switzerland is an excellent strategic location within the center of Europe. It has a well-developed infrastructure with a stable political and economic environment.

Switzerland has ranked as 4th in the world under the Heritage Foundation Index 2017. Besides the most important thing is that it has comparatively low Personal and Corporate taxation system. This taxation system provides a comfortable and appealing business environment for foreign investors. So, opening a company in Switzerland will be beneficial to them in many ways. Before a company registration, it’s important to choose which type of business structure it will be.

The following are the most common legal entities of Switzerland that investors can choose from:

| Basic Requirements | LLC | LLP | Public Limited Company | Representative Office | Branch Office |

| Require resident director/manager/partner/legal representative | YES | YES | YES | YES | YES |

| Minimum number of directors | 1 | 1 | 3 | 1 | 1 |

| Minimum number of shareholders | 1 | 1 | 1 | Parent Company | Parent Company |

| Least paid up share capital (EUR) | 18,500 | 18,500 | 91,500 | 1 | 1 |

| Time to incorporate | 1 month | 1 month | 1 month | ||

| Self-companies available | YES | NO | YES | NO | NO |

| Preference shareholders/partners | YES | YES | YES | NO | NO |

If any foreign or local investors want to open a company in Switzerland, they will need to complete all the following steps of incorporation:

Choosing a name for the company

The foreign or local investors will need to select a proper company name before they can open a company in Switzerland. They can check the existing list of federal registries of all company to reduce the possibility of denying the name. The chosen name has to approve in an official way before the registration of the company. Moreover:

Becoming an Independent or partnership

He or she can open and register an independent company or also open a partnership business or company if they decide to work together.

Independent:

Partnership:

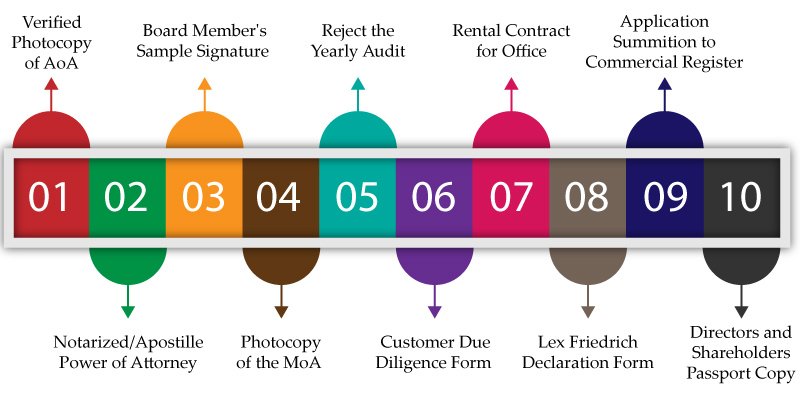

To register a company in Switzerland, the investors must provide important legal documents to the registrar. The documents are:

The new company needs to submit the correct documents for easy company registration in Switzerland. The company formation can be complete in about three weeks if the investors successfully provide the least share capital.

Read Also: How to register a company in Switzerland?

Opening a Bank Account

The company formation process in Switzerland starts with the opening of a bank account. After placing the paid-up capital, the bank will issue a receipt for the amount to register the company.

Banking Considerations in Switzerland

| Multi-currency bank accounts available | YES |

| Feature of e-banking platform | Excellent |

| Crowd funding possible | YES |

| Corporate visa debit cards accessible | YES |

Depositing least share capital

Auditing

The investors need to register for VAT and for taxation purposes after obtaining incorporation certificate from Swiss Companies Register. Some company needs to get special licenses or permits. Then the last step that is to register the employees for social security and insurance.

VAT

Taxation

Employees Enrollment into the Social Insurance System

Trademarks

| Benefits of Company Incorporation | Problems of Company Incorporation |

| Easy company set up processes | No limit to debt |

| Huge reputation for legal security and long-term stability | Starting company is comparatively expensive |

| Stable, friendly and anticipated political environment and taxation system | Difficult to secure residence visas for non-EU citizens |

Conclusion

Compared to other major EU countries it’s much easier to set up and register a company in Switzerland. It has a fair bureaucracy scheme with a reasonable taxation system. So, the investors can enjoy a pro-business environment with various tax incentives and high labor force.