13 Major Facts Know Before Doing Business in Bangladesh

There are many advantages and problems doing business in Bangladesh as a foreign company registration in Bangladesh. Before starting a business in Bangladesh, a foreign company needs to focus on local labor cost.

13 Major Facts Know Before Doing Business in Bangladesh As Foreigner

Check discussed 13 major facts of doing business in Bangladesh as local and foreign entrepreneurs. S & F Consulting Firm assist foreign investors under FDI law to open business. Since 2012, S & F doing consultancy business professionally in Bangladesh. Although it’s not quite good place of foreign investment still much more opportunities shaking hands of investment to generate good revenue. As welcoming guests and not allowing them to have sit is bad practice that is present in Bangladesh.

| Company Registration Hassle | Skill and Unskilled Labor | Why invest in Bangladesh |

| High Income Tax Rate | Problems to hire foreign staffs | Economy of Bangladesh |

| Culture | Advantages of tax zone | FDI position |

| Unemployment rate | Investment Opportunity | Problems of doing business |

| Investment Sectors not open | Q & A | Comment |

1. Company formation Hassle

Well, are you planning of doing business in Bangladesh as foreigner? Just check the followings:

| Company | Licenses | Authority |

| Private Limited | Incorporation | RJSC |

| 2 Share Holders | Trade License | City Corporation |

| Min. Capital Taka 50,000/- | TIN (Tax Identification) | NBR |

| 7-10 Days’ time require (Incorporation) | VAT (Value Added Tax) | NBR Local Office |

| Cost: Taka 90K to 400K | Chamber of Commerce | DCCI, BGMEA, BKMEA, IBCC etc |

| Subsidiary allowed | Export and/or Import | Commerce Department |

| 100% shares can hold by foreigners. | Work Permit/ Visa | BOI and/ or EPZA |

2. Local Labor and Cost

LABOR cost in Bangladesh

Actually, there is no legal frame in corporates of minimum hiring level Except factory and garments workers, Taka 12000 (proposed). Expected and average salary structure in corporates of Bangladesh are as follows:

| Executive | Manager | GM/ CEO |

| Taka 15,000-25000 | Taka 25,000-50,000 | Taka 100,000-300000 (above) |

| USD 1000 (foreign workers) | USD 1500-2000 (foreigners) | USD 5000 above (foreigners) |

| Skill/ technical workers are excluding. |

3. Investment Sectors

Any sectors investment is secure if have good knowledge and idea in case of doing business in Bangladesh. Besides following sectors are likeable:

| Garments | Export and Import | Medicine |

| Textile | Electronics | Tourism |

| Projects | Infrastructure | Property Development |

| IT | Power | Food |

| Telecommunication | Consumer Goods | Software |

4. Income Tax Rate

Income tax has to pay all nationals when get salary of Taka 15,000/ monthly at minimum scale. In case of corporate tax vary from service to service and nature of business to business. Whereas corporate tax for the nonresidents shareholding companies are fixed at rate of 30%. Whereas 10% additional incurred upon declaration of revenue, applicable on foreign shareholding companies. For information, technical and skill engineers or workers can apply of tax exemption.

5. Hire Foreign Staffs

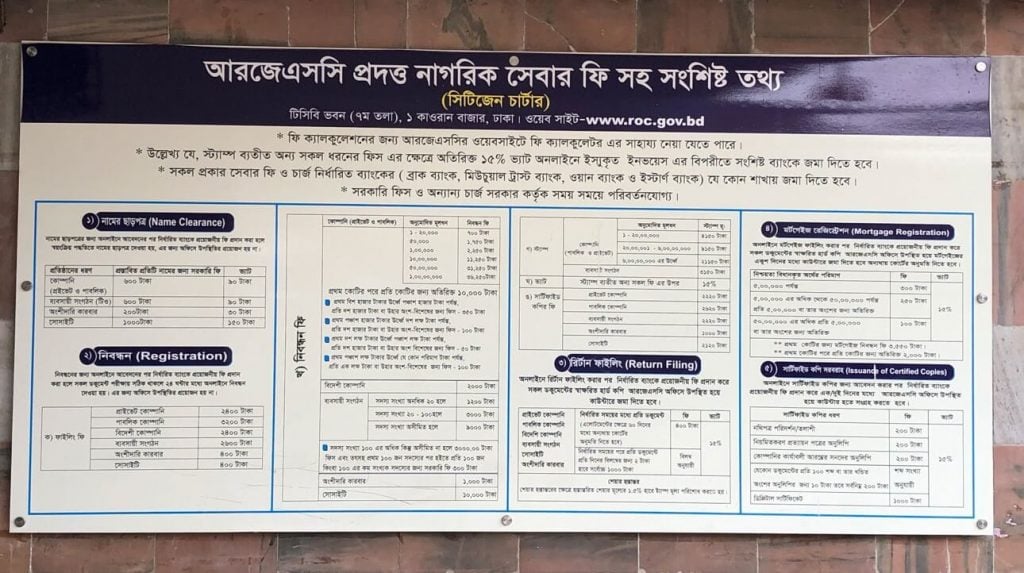

RJSC Bangladesh chart

There is a process of hiring or importing foreign staffs in Bangladesh:

| Supporting papers | Supporting papers (2) | Authority |

| Financial letter | Newspaper advertisement | BOI |

| Appointment letter | Board Meeting Resolution | EPZA |

| Academic certificate | Prescribe form | Ministry |

6. Economy

GDP status as follows

| 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

| 6.06 | 6.55 | 7.11 | 7.28 | 7.86 |

Source: https://www.thedailystar.net/business/bangladesh-present-gdp-growth-rate-7.86-percent-in-2017-18-1635835

7. Culture

Office working days: Sunday to Thursday, 9.30-10.00 am to 5.30-6.30 pm, normally 8-8.30 hours.

Holidays: Shopping mall and super shops are open till 10.pm whereas all other retail shops are closed by 9 pm.

Festival: Yearly 2 big festivals are celebrated apart from some other religious festivals. Muslims, Hindus, Christians and Buddhists festivals are positively celebrated jointly all people.

8. Advantage of Tax-Free Zone

9. FDI (Foreign Direct Investment) status

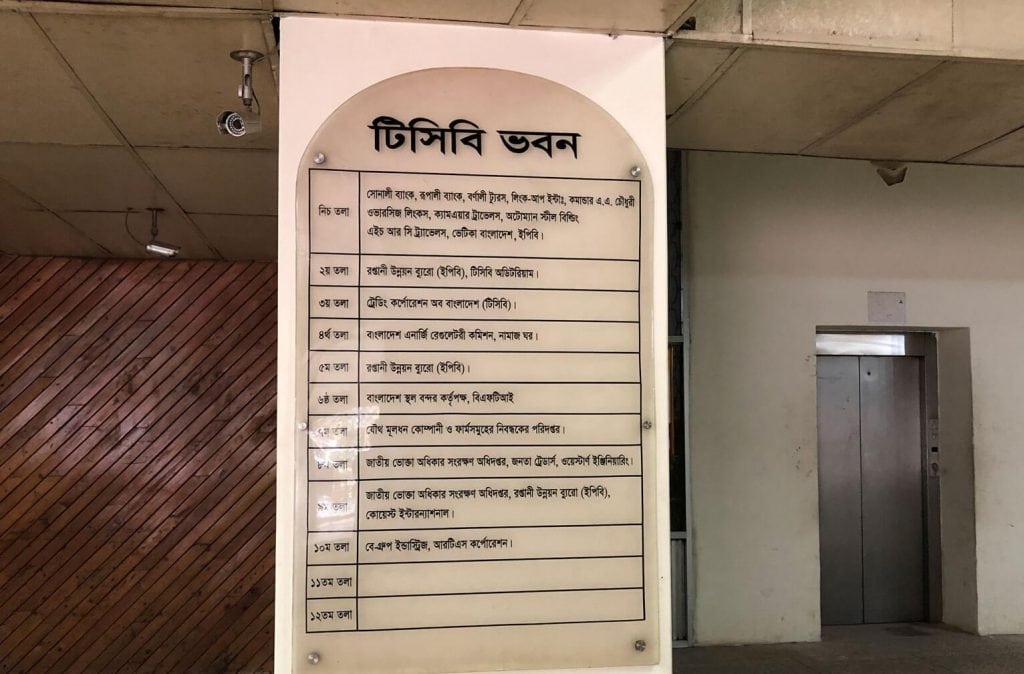

Trading Corporation of Bangladesh

As record of central Bank of Bangladesh FDI received around USD 950 plus in one decade ago whereas USD 2500 million recorded in 2016-17 that is significant., Source: https://www.dhakatribune.com/business/2018/09/05/bangladesh-ready-for-massive-foreign-investment

Bangladesh require USD 6.5 billion plus to overcome power of middle class country from lower middle as source https://www.daily-sun.com/printversion/details/304047/2018/04/23/Bangladesh-needs-better-investment-climate-for-FDI whereas FDI received USD 2500 million plus in lately.

| FDI 2008 | FDI 2018 | Require |

| USD 950 Million | USD 2500 Million | USD 6.5 Billion |

Reducing fixed cost bring opportunity of profit is main reason of investment in Bangladesh.

10. Unemployment rate

Around 4.4 millions people are unemployed in Bangladesh as report of 2018, Source: https://www.dhakatribune.com/bangladesh/2018/09/25/4-4-million-youths-face-unemployment-in-bangladesh Unemployed ratio become double in last 7 years, source. It’s worried news that around 2 million of higher educated people are unemployed, as report of Daily News Paper in Bangladesh. This is also another reason of foreign investment in Bangladesh to take opportunity doing business and generate revenue within short time.

11. Bangladesh Investment Opportunity

i) Government big project

As Bangladesh investment opportunity and is middle developing country huge number of big projects (billion USD) are ongoing and upcoming. We have noticed Indian, Japanese, Chinese and Italian investors taken tender alone or jointly with government to complete mega project and Singapore embassy in Bangladesh. As being most of the government project is tax free good opportunity of investment in Bangladesh.

ii) Power

Bangladesh government import and borrow Electric power from overseas by high price. Besides, local and joint venture power supply is not sufficient to meet current demand. As a result, load sheading / power off condition happen everyday for some times (1 hour) in town area and more than 2 hours keep power off in rural area in Bangladesh. It’s declared as tax free investment and business for certain period.

iii) Road and High way

Roads and highway renovation, extension and construction are regular jobs of Government in Bangladesh. Huge number of budgets is passed by parliament in this sector and being corrected jobs are assigned to military or foreign organizations to compete within time frame.

iv) Garments

This is number one business opportunity in Bangladesh that is pile of economy of country. Bangladesh bid in global markets to meet demand of clothing. Why buyer’s choice Bangladesh? Some main reasons are being low manpower cost clothing price become lower than competitors. Besides, raw materials, supporting materials, skill labors are available. And key point is import and export tax is .82% that attract and inspire investors.

v) Textile

A lot of textile industries situated in Norshingdi, Savar, Narayangonj, Gazipur and Tongi area. Clothing colors, raw cotton to cotton, cloth washing, clothing design and all types of textile mills situated in this area. Skilled, semi-skilled and fresh workers contribution in eye catchy situation and is a reason of doing business in Bangladesh smartly.

vi) Electronics import/ manufacture

Fridge, woven, Refrigerator and others electronics goods are imported 90% to meet demand of market and business setup in Bangladesh. Local producers are doing well with others but success rate not always good as good opportunity of business for foreign investors.

vii) Vehicle manufacture

Motor bike, Heavy truck, lorry, personal car and bus are imported with paying tax more than 3 times of original price. It’s tremendous business opportunity in Vehicle manufacture sector if manufacture locally.

viii) Toy production

Actually, toy’s is popular business in all country and Bangladesh is one of them. But most of the toys are imported from China and locally is produced 5% of demand.

ix) Cement and bricks factory

Till now, foreign cement companies are holding market leadership although local producers are taking leadership in some market sectors. Bricks factories are caused of pollution and do the business for certain period exclude rainy season and flood time in Bangladesh. There are good opportunities still open to start bricks factory considering production will continue whole of year.

x) Furniture export

Export promotion bureau Bangladesh

If you notice, around more than 300 ready furniture shops are available in Mirpur, Dhaka area and another 400 shops at Mirpur Stadium Market. Woods are supplied from Chittagong and Khulna area (forest) to meet demand. Now a day ply wood and different types of wood board are imported to make home and office furniture while tree wood is costly.

i) Insufficient Government facilities

Difficulties start from new company registration to start and selling product or services in Bangladesh. Corruption, unaware government and bank staffs of FDI rules, not capable to handle foreign shareholding companies and so on issues comes when startup business in Bangladesh as nonresident.

ii) Political issue

In view of normally political situation is under controlled by government, but many things are happened those are overlooked or let others overlooked forcibly to cool the situation. Democracy is absence in Bangladesh and people are trying to posed voting right back are affected of doing business in Bangladesh as nonresident.

iii) Low quality administration

All power government party use administration people as own to dominate others is regular practice in Bangladesh.

iv) High tax for foreign companies

Foreign shareholding companies have to pay 30% tax along with 10% additional if profit is declared or salary received by foreign directors.

v) Money transfer in overseas is restricted

Money transfer from Bangladesh to overseas is restricted as a result foreign company owners face difficulty to take back profit of company is major problems of doing business.

13. Why business in Bangladesh?

Low manpower cost-Manpower cost is cheaper than many other countries as a result fixed cost minimize bring profit of company initially.

Supporting material availability-Business supporting ingredients, materials and goods are available that make full of production and reasonable price.

Easier to generate revenue-Being low manpower cost, transport, raw goods, rental, loan facilities to import machine and etc. assist to generate revenue as fixed cost is low.

Miscellaneous cost reasonable-Living cost, staffs festival, supplier, retail marketing and so on cost of doing business in Bangladesh is lower.

Read more: Small Business Ideas In Bangladesh

Q & A session

Which one is the best investment sector?

Garments and Big projects

Is there any bank suitable for foreign company?

No, not well-known most of banks

Which banks are recommended?

Eastern, NRB, City and SBI.

How long takes to start export import business?

30-45 days

How long takes to manage garments factory and full setup?

3-5 months

Why garments factory setup takes long time?

As around 20 more licenses are required

How long takes to start service company?

10-15 days

How can assist S & F Consulting Firm?

As S & F is consulting firm and expert on FDI so can trust us to assist of arranging any license for foreigner.