We shall discuss how to register a company in Indonesia as a foreign investor in a desirable sector (s). Indonesia is a country located in South East Asia (SEA). It consists of more than 17,000 islands. Its main island, Java, is where the capital city of Jakarta lies.

It has a large population of 260 million people (2017) and has a very diverse ethnic group. It’s known for its beaches in Bali, volcanoes, Komodo dragon and many others. It is also home to some ancient Buddhist structures such as the Borobudur, as well as ancient Hindu temples such at the Prambanan and Uluwatu temples.

Indonesia is not popularly known to be as an investment destination or to start a business. This was due to its reputation of high levels of corruption and mismanagement of the financial sector. Although there was some economic growth in the late 80s to 90s, the growth couldn’t be sustained due to this improper management.

How to register a company in Indonesia

However, with the changes in government in recent years, the new administration has brought much needed change and this has seen the country improve rapidly and was one of the fastest growing economies in SEA. The Indonesian currency is the Indonesian Rupiah (IDR).

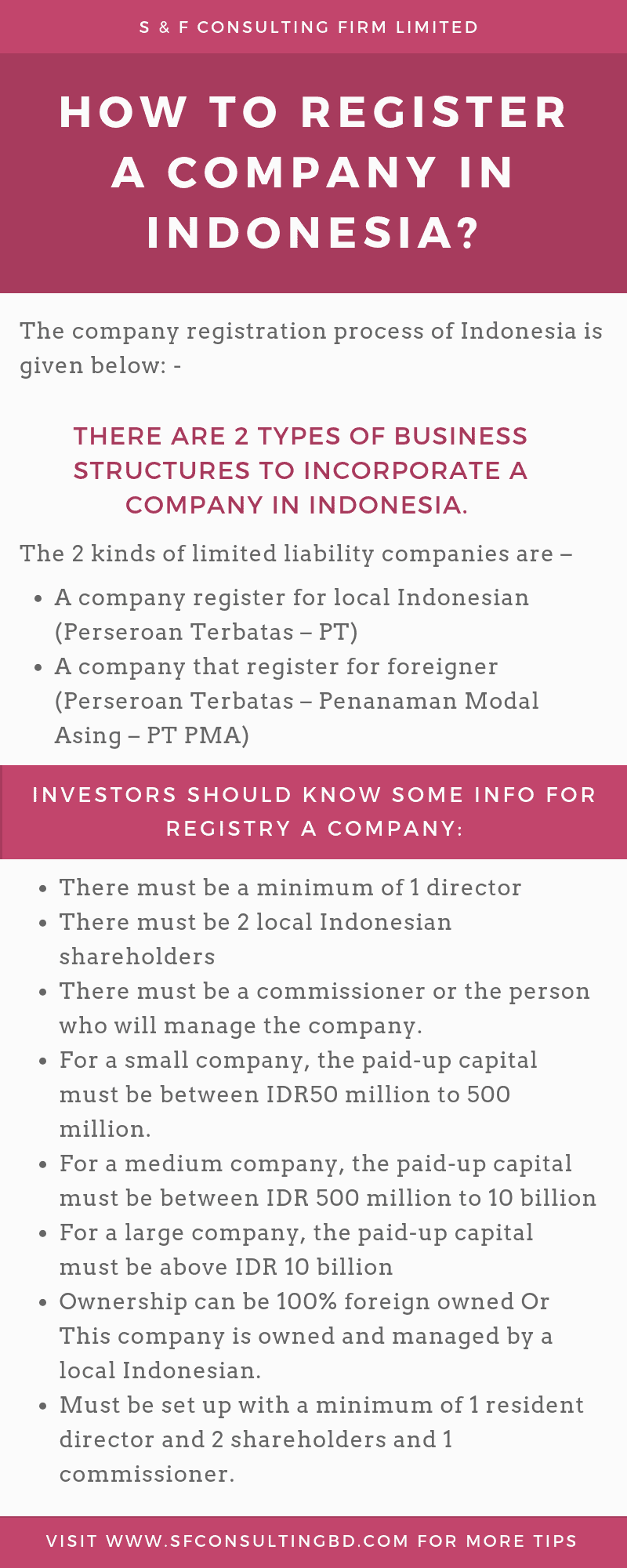

There are a few choices of business structures to incorporate. The description and the process of register a company in Indonesia (limited liability company) is given below: -

There are 2 kinds of limited liability companies in Indonesia –

Features of the PT and PT PMA

Foreigner and local investors can register these two types of company at easily, with some requirements.

Ownership can be 100% foreign owned. However, this will depend on the business classification. Those businesses that are not on the Negative Investment list can be 100% owned. This Negative list is a list of industries where a foreign-owned company is prohibited from registering a company in Indonesia.

This type of company is governed by the Foreign Capital Investment Law. This company type is required to obtain approval from the Capital Investment Coordinating Board (Badan Koordinasi Penanaman Modal – BKPM) before starting the business. As required by BKPM, the owner must have a share capital of a minimum of IDR10 billion of which 25% must be paid up as share capital and go through with business ideas in Indonesia.

Must be set up with a minimum of 1 resident director and 2 shareholders and 1 commissioner.

If the company is 100% foreign owned, the owners are required to sell at least a 5% share in the company to a resident Indonesian within 15 years of commercially starting the business.

There are no restrictions on the area of operation except for the Negative list. The company must obtain the relevant licenses from the respective government authorities where they are operating and this is how to register a company in Indonesia.

Other information of register a company

As for the tax rate, the corporate tax rate in Indonesia is 25% for both domestic and foreign sourced income.

If there is a need to appoint new shareholders, this is normally done in a General Meeting of Shareholders together with a board of directors.

Should there be a decision to wind up the company; this is also normally done at the GMS. Once the decision is made and a resolution passed, a liquidator will be appointed.

Within 30 days of the appointment of the liquidator, the person will announce the liquidation in the newspaper and the State Gazette of the Republic of Indonesia. All the creditors must then submit their claims and these claims will then be settled.

Indonesia has improved tremendously in the Ease of starting business ranking from the World Bank data. It jumped to 91 in 2017 from 106 in 2016. This reflects the government’s intention to bring in more investments into the country.

The process of how to register a company in Indonesia stated below is for the city of Jakarta. However, the process should be quite similar in other cities in the country.

Pay the fees to obtain clearance of the company name– This is done by a Notary Public and can be done through a computerized processing system. This is done at a Notary Public together with the reservation and clearance of a company name.

The Notary must initially pay a fee of IDR200, 000 at a bank before the clearance of the name can be obtained. Once payment is made, the Notary will receive a payment receipt with a code. This process normally takes 1 day.

Clearance of name at the Ministry of Law and Human Rights –The code obtained from the 1st process is keyed into the system online when reserving the company name.

The reserved name will be kept for 60 days. The Ministry of Law and Human Rights (Kementerian Hukum dan Hak Asasi Manusia) MLHR reserves the right to reject a company name if it contravenes certain set criteria. The Company’s Name Application Form must be submitted to the MLHR which contains –

The MLHR will then give the approval of the company name electronically. This will usually contain –

The above process takes less than 1 day.

Notarize company documents – The Notary Public will obtain the standard form of the company deed and will notarize these documents. The maximum fees that the Notary may charge with an economic value of above IDR100 million up to IDR 1 billion are 1.5% of the total value of the object of the deed. This process takes 1 day and can be done simultaneously with step 2.

Apply to MLHR for approval of the deed of an establishment –This step takes less than 1 day where the application for the approval on the establishment of the company is filed electronically together with the certificate of bank account and a copy of the relevant bank transfer advice.

- IDR 1 million for the validation of the company as a legal entity

- IDR 30,000 for publication in the State Gazette

- IDR 550,000 for publication in the Supplement State Gazette

This process takes 1 day.

Apply for the permanent business trading license and the certificate of company registration – This is done at the Ministry of Trade. The application for the permanent business trading license (Surat Izin Usaha Perniagaan – SIUP) must be submitted with the following documents –

This whole process takes about 7 days.

Register with the Ministry of Manpower – The applicant must submit a manpower report to the ministry within 30 days as of the establishment of the company together with the following documents –

This process takes 1 day.

Apply for Workers Social Security Program – This process which takes 7 days is to take care of the workers occupational accident security, old age security, pension security and death security.

This is done at the Badan Penyelenggara Jaminan Sosial (BPJS) Ketenagakerjaan office and the applicant must obtain forms 1 for data and 1A for employee’s data. The application forms must be submitted to the BPJS Ketenagakerjaan office within 30 days after obtaining the forms together with –

Apply for healthcare insurance – This is done with the BPJS Kesehatan and takes 7 days but is simultaneous with the above process.

Obtain a tax payer registration number (NPWP) and VAT collector number from the tax office. This takes 1 day as can also be done at the same time as the above step. I hope you will not seek any more information asking how to register a company in Indonesia as a foreigner.

The following are the important contact details of the government authorities –

Address: Jl HR Rasuna Said kav 6-7, Kuningan, South Jakarta, DKI Jakarta, Indonesia 12940

Organization)

Address: Jl Jendral Gatot Subroto, No 79 Jakarta Selatan, Indonesia 12930

Address: Jl Gatot Subroto Lot 40-42 Jakarta Indonesia 12190