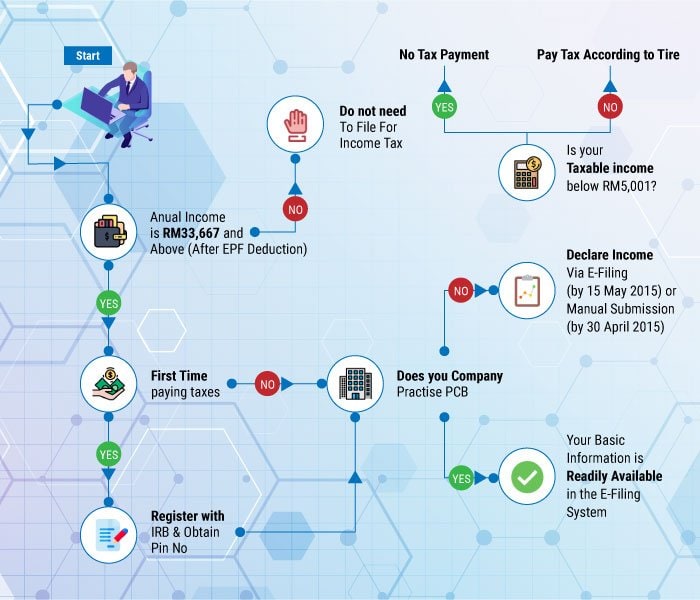

This is a type of tax that the government applies to individuals and business or companies based on their net income. This tax is used for the development of the country, paying the salary of government workers (including the police force and firefighters). If your annual income is over RM 34000, you need to register a tax file. If you are a foreigner employed in Malaysia, you must notify your chargeability to the non-resident branch or the nearest IRBM branch by 2 months of your arrival in Malaysia. If you fail income tax, you will be charged 300% of the amount (no prosecution). For let payable tax you will be fined 5% of the amount. More about income tax filing and process of income tax returns are discussed below: -

Limited Liability Partnership (LLP), LLC, Society, trusty bodies are liable to pay tax to the government every year. Those corporations have not started a business are not responsible to apply CP 204. The taxpayer needs the following: Tax return form and forwarding letter with supporting papers

You will be charged with 10% additional cost if you fail to pay monthly instalment tax. If Malaysian income tax office found the difference between an actual and estimated tax, you will be charged with 30% fine instead 10 %.

| Income Source | Deadline | Penalty |

| Employment but no business | 30th April | 10% fine on the total payable tax |

| Business | 30th June | Additional 5% fine (total 15%), if tax payment is not paid within 60 days |

If taxpayers are not satisfied with the assessment of income tax, then they are allowed to file an appeal. The appeal must be made within 30 days from the date of the notice. You need to write an appeal to the branch of IRMB. It is necessary to fill the Q form to forward the appeal to the special commission of Income Tax.

Other necessary information’s are shown in the table:

| Mode of payment | You can made payment at the counter of IRBM by Cheque. By bank draft at the bank and through internet. |

| Corporate Tax Rate | If paid up capital is less than RM 2.5 million 1st RM ½ million: 19 % (Tax)Other balance: 24 % (Tax) |

| Tax for individual | All types of income are taxable in Malaysia. You need to pay tax - If your income is over RM 34000 per year Individual tax rate is 28% |

Read Also - The sales and service tax (SST) in Malaysia

Now income tax registration is much easier than before. You can register your tax file through online. First of all, you need to register at ezHASiL e-Filing website. Remember, you need to register as taxpayers while registering for ezHASiL e-Filing. The process of registration is discussed below: -

| How to register Tax file? | For tax file registration contact with your nearest income tax office |

| Documents requirement | Form 9: Certificate of registration Form 49: Name and address of the directors Documents needs to be certified by Company Secretary. |

| Offences | Provision | Fine (RM) |

| Failure to process income tax form without cause | 112 (2) | RM 200-2000Imprisonment or both |

| Failure to give the payable tax without valid cause | 112 (2) | RM 200-20002Imprisonment or both |

| If improper tax return is made | 113 (1) (a) | RM 1000-10000200% additional tax |

| If incorrect information is given | 113 (one) (b) | RM 1000-10000200% additional tax |

| Intentionally if any person assists others to evade tax | 114 (1) | RM 1000-20000 300 % additional tax applicable or imprisonment or both |

| Assist others to declare income | 114 (1 A) | RM 2000-20000imprisonment or both |

| Attempt to go out from country without paying tax | 115 (1) | RM 200-2000 Imprisonment or both |

| Obstructing any authorized of IRBM | 116 | RM 1000-10000Imprisonment or both |

| If fails to keep proper papers | 119 A | RM 300-2000Imprisonment or both |

| If change office address without notice | 120 (1) | RM 200-2000imprisonment or both |

| If pay tax after thirty (30) June of business | 103 (4) | 10 % or 5 % additional tax will be applicable |

You can close your tax file if following things happen -

This article describes the Tax filling system in Malaysia. Moreover, it describes the entire procedure of e-filling registration, penalties for not paying tax and may more. The online tax file registration makes the registration process much easier. However, if you face any complication, S&F Consulting Firm is always there for you. Also, you may want to know about limited liability companies in Malaysia.