Bismillahir Rahmanir Rahim

Entrepreneurs worldwide can get current information about the steps, processes, and fees regarding the online registration of Sdn Bhd company in Malaysia. It takes 4 to 5 working days to register a company in Malaysia. Shareholders can register a company from anywhere in the world. The registration cost starts from 2500 to 3100 Ringgits. Call us: +601151177141

let us update you about the nature of the Business, the registration fees and the processes involved in registering a company. It will not be wrong to say that Sdn Bhd company is one the best choices for foreigners to register a new business company in Malaysia. In the local language, a Limited Liability Company is referred to as Sdn Bhd company, also known as Sendirian Berhad company (Sendirian Berhad company).

https://youtu.be/z6CXF7gQirQ

Company Formation Cost, Requirement, Process & Time in Malaysia

Step 1: A person who is an expert or a company secretary by law can register a company under the SSM guidelines.

Step 2: The company secretary is required to create a form for the shareholders of the Company to get that form signed for Non-bankruptcy from the respective countries.

7-easy-steps-of-registrationDownload

Step 3: It is one of the important to choice three proposed names of the business, check here name search of SSM .The registration of the Company’s name is a hectic process as many other companies are registered in a month.

Step 4: The businessman is required to share the relevant information about the nature of their email, contact number, to enhance further the chances of establishing their Company. Note; only three business natures are allowed in one Company.

Step 5: The next step is for the COSEC to make an online payment for the reservation and confirmation of the Company’s name and submit the form to SSM. The validity of the approved Company’s name will last for 30 days unless it gets an extension.

Step 6: The overseas shareholders are required to contact the concerned bank officer or SFM CONSULTING FIRM SDN BHD to learn about the requirements of opening a fresh business account. The advisor or consultant can help to make it easier to create a bank account.

Step 7: The secretary of the Company will certify the Company’s incorporation certificate as it is the bank's requirement. Further details of the registration fees of Sdn Bhd company will be discussed in this article.

Sdn Bhd Company in Malaysia is the only company that is suitable for foreign-owned businesses. Overseas business people cannot get sole ownership of a company by law. It is only allowed for the local people in Malaysia. Malaysia register company by in total eight types as follows.

The ownership of a sole proprietorship is only allowed to the local IC holder through the process of SSM and under the business Act of 1956. Sdn Bhd business has much more bigger responsibilities than enterprise business.

It is due to various reasons such as Low income tax, there is no requirement for annual filing return to SSM on due time, it is much easier to create and finish. The registration fee for business only 30 RM as per the information given on ROC and SSM websites. Lastly, appointing a secretary for Company is excluded.

Proprietorship company formations steps are 1) Fill up a form and submit to the counter of SSM to verify by officer. 2) SSM officer will check the name availability 3) Make a payment of online new registered Company’s purpose RM 60, Name purpose RM 30 and branch RM 5 only. 4) Applicant need to wait for 1-2 hours to receive business registration certificate after making payment.

How to register a business on partnership?

In Malaysia, more than 2 to 20 people can register a business on partnership. There is no need to appoint a secretary for the Company nor there is a share capital. Malaysia register company process for a partnership business is exactly the same as it is for sole proprietorship, visit: ezbiz Malaysia

It is necessary to check the proposed name in the search counter of SSM. The next step is to fill up the form provided by the SSM office and pay the required registration fee. The reservation fees for the Company’s name us RM 65. Companies on partnerships are much easier to get and run for local people in Malaysia. Some of the things that are important to register a company are, name and address of the Company, IC card and fee information.

Some of the benefits are:

When a new company is registered and it is publicly announced, the liability of that Company is spread by the employees working in that Company. There are two different types of CLG companies, 1) With Berhad (Bhd) and 2) without Berhad (Bhd). The first and the foremost objective of the business CLG is to promote and recreation. A suitable candidate may be appointed as a director of the Company on the demand of SSM officer. Do you the what processes are involved in registering a company and what documents are necessary for the registration of a Limited company in Malaysia? .

Some of the key requirements for the registrar limited guarantee company ((CLG) are; the name and address of the Company, main goals and objectives of the Company, and authority of the employees. CLG is established under the Companies Act 2016.

The Company is required to have the following things:

The first and the foremost important thing for a company to have minimum 3 to 4 business partners.

To register a public limited company in Malaysia, one must have minimum of 2 partners and at least one local sponsor to promote the Company. PLC is formed under company act 2016.

The following things are important:

1. A registered name of the Company is required.

2. A proper addrss of the Company is needed.

3. The details and information of contact is exactly the same as Sdn Bhd company formation.

The LLP, also known as Limited liability partnership business is established under company act 2016. The registration fee for LLP is RM 500. As per the legal terms and conditions the corporate, accounting firm, law firm and joint venture companies are built up under the format followed by LLP. To register LLP, one must have at least 2 partners.

Some of the requirements for the formation of LLP company are:

Now, it is the time to discuss Sdn Bhd company. Only foreigners are eligible to register Sdn Bhd company.

The following are some of the steps to register a company in Malaysia:

Note: Malaysia register a company pre and post-process

The CS (COSEC) must prepare forms and make online submissions to SSM to perform the duty. For the documents process log in in MyCOID

The following are some of the important points:

1. The name of the copy and its incorporation copy.

2. BORANG PNA 42 is a platform for the registration of a business name in Malaysia.

3. BORANG A is a form needed for the incorporation. · For further incorporation there are two forms namely;

The only option for foreigners to register a company is Sdn Bhd company in Malaysia. However, for foreigners to open a new company they must full fill the documentation process which is discussed below:

Requirement-of-company-registrationDownload

Once the above mentioned process is completed, the director of the Company receives a business registration certificate. The SSM shares a fresh and brand new Sdn Bhd Company registration certificate through email. The certificate and other forms given by SSM are mandatory to start a new business in Malaysia start business in Malaysia:

Note: You can purchase other important forms from SSM if required.

For the set up a company in Malaysia as a promoter, you are required to discuss it with a consultant for SSM fees. In Malaysia, the overall cost of the Company’s set up and its fee highly depend on offers and services provided by the consultant. The following shows the fee required to incorporate a company.

| Registration | Fee | Duration |

| Sdn Bhd Company | 2500-3500 | 3-5 days |

| Company Secretary & Annual Return (from 2nd year) | 600 | 12 months |

| Open Bank Account (Initial. deposit) | 10000-50000 | 7-14 days |

| Signboard & Premise License | 1500-2000 | 7-10 days |

| Export & Import License | 3000 | 1-3 months |

| Halal License (Requirement of alcohol) | 3000 | 15-30 days |

| ESD registration & Work Permit | 8000-12000 | 1-6 months |

| Tax filing | 1000-1500 | Yearly |

| Accounts & Audit | 3000 to above | Yearly |

| Wind Up (Tax, audit and closing) | 4000-5000 | One Time |

Fees information

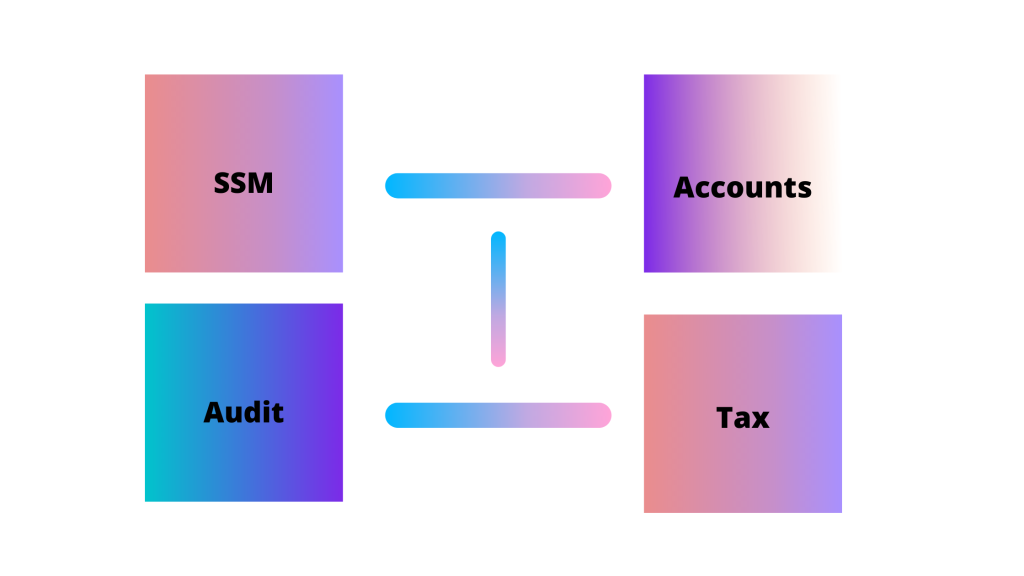

The investors are scared of annual cost after opening a registered business. Let us find out what is needed to be done every year as a director of the company

:

SSM cost

As per the SSM guideline in Malaysia every Sdn Bhd company is required to submit yearly return within due time. Keep in mind that in Malaysia return filing to SSM is different from income tax filling. The annual cost ranges from 150 or more as government fee is insufficient.

Consultancy companies services are more expensive for the entire year to the companies or clients. Moreover, the Company’s secretary fee ranges from Ringgit 600 to 1200 based on the nature of the firm. Note that it is all about the yearly business registration fee in Malaysia

Financial statement/ Bookkeeping/ Accounting fees

To avoid financial penalty, the limited (Sdn Bhd) companies should make FS (financial statement). The fees for accounting and book keeping is not fixed. It depends on the accounting companies and the number of transactions. It charges from RM 800 to 1000 for dormant company.

If the director has his own house and is chartered accountant in his own county who knows about the Malaysian accounting system will be preferable.

Audit service fee

In Malaysia, the chartered accountant of a company is required to sign the FS and attaching an audit report page. The auditor job is to keep an eye on all the transactions and supporting documents of income as well as expenses as part of the procedure. The income tax filing is almost impossible without the audit copy of income tax (T & C apply).

As per the practice in Malaysia, the fee for audit service for dormant Company is imposed ranging from Ringgit 1000 to 1200. The fee range for an active company starts from RM 2000 to 5000 or more.

Income tax filing

The tax agent is required to submit Company’s tax filling with the help of audit copy. There are certain forms provided to the director of the Company to sign and submit it in LHDN (tax department). The fee for tax service starts from RM 800 to RM 1500. Usually, corporate income tax rate is 17 percent in Malaysia.

This is highly irresponsible if a director of a company conveys wrong or false information about not submitting file as no business is done in the entire year. The Company’s director must know about the following annual responsibilities:

What will happen if you did not follow the above mentioned instructions? Well, SSM will give you a gift voucher of RM 5000. Furthermore, there is another gift box from a tax department known as LHDN. It is for those companies who do not submit taxation on due time. The penalty amount ranges from RM 5000 to RM 50000. In future, they will pay for it if the employees of a company avoid to submit the return.

Is it easy to open a bank account in Malaysia? Well, the local banks in Malaysia do not entertain foreign shareholders or shareholding companies to open a bank account. However, the following are some of the banks available for the non-resident shareholding companies to open a bank account.

Apart from the local banks, the international or foreign banks give permission to the foreign shareholders or shareholding companies to open a bank account in Malaysia under certain terms and conditions. One of the foremost important conditions is to deposit initial amount of RM 30K to RM 50k. The initial deposit can be withdraw through online transfer or cheque. For opening a business account the foreign shareholding companies can visit foreign banks.

The joint venture company follows the same formation process as Sdn Bhd company where a company is based on one foreigner and one local. Moreover, other requirements such as, Shareholding, and paid up capital are exactly the same.

The information of Passport for non-residence and IC for local must be provided to super form and MoA. The Company’s shared allotment company is divided as per the discussion of Company’s board meeting.

Purchasing a share in joint venture is allowed to anyone as per the general process proposed in Malaysia. If any of the Company’s local directors is not invited, the JV formation as local is considered as silent partner with zero shares.

In Malaysia, the WRT license is applicable for all retail and wholesale entities.

The registration of Labuan company is done under the Labuan company act 1990. The applicants are required to appoint Labuan trust company to finish the incorporation process. The name registration fee is RM 50.

The maximum time to complete the limited company incorporation process is 36 hours. The fees structure for the registration of Labuan business are given below:

The Foreign investors are required to contact us free business consultancy through our official email address or WhatsApp. The Representative of S & F Consulting Company will provide a complete guideline to complete Malaysian Company’s registration process within due time. Feel free to contact us from all across the world regarding the formation of a company, creating a bank account, business licensing and application for work permit. S & F Consulting Firm Limited is considered as a parent company and the local company name is SFM CONSULTING FIRM SDN BHD. There is no extra costs and services in our package as mention in the information given in our website.

What is SSM Registration meaning?

SSM is a government organ that is responsible to register business in Malaysia. SSM meaning is Malay language Suruhanjaya Syarikat Malaysia. Enterprise, partnership, Sdn Bhd and foreign branch office's are registered through SSM.

Can one shareholder is allowed of online Sdn Bhd company registration in Malaysia?

Yes, either shareholder is foreigner or local, at least, one shareholder is required in a company by law for registration.

Can foreigner own full shares of the company?

Yes, by law, foreign shareholder can hold 100% shares of own company without local partner.

How can start Super shop, Restaurant, Grocery, Pasar Mini in Malaysia as foreigner?

Well, once complete your Sdn Bhd company establishment after then you must apply for signboard & premise license. After then, apply for WRT license from concern ministry/ government department (MIDA).

Foreign ownership companies must keep either paid up capital of the business in Malaysia Ringgit 1 million to start retail business or have local partner who will hold majority shares.

As WRT license is applicable unless have local partner in the companies and to obtain WRT license paid up capital shall be Ringgit one million. More information to start Super shop, Restaurant, Grocery and Pasar Mini in Malaysia.

What are the documents required for companies registration?

Passport copy, basic information of promoter, contact detail, local residence and business address in Malaysia and signature on a form as declaration of non- bankruptcy.

When Ringgit 500000 is required to show paid up capital?

Well, if foreign directorship companies have plan to apply for ESD and work permit paid up capital of the company must have 500K.

When Ringgit 1 million paid up capital is required?

OK, if the foreign ownership company plan to start wholesale and retail business must have equity investment Ringgit 1 million as WRT license is applicable.

What are the requirements to open bank account in Malaysia, HSBC, SCB, UOB bank ?

To open bank account in Malaysia following documents and information are required: 1. Companies incorporation copies issued by SSM 2. Board Meeting Resolution 3. Source of income 4. Income tax copy of the foreign directors 5. Initial deposit amount Ringgit 10000. Monthly fee Ringgit 18-30 unless maintain minimum balance as T & C of bank.

Can foreigners open a company by capital Ringgit 1 (one)?

Yes can, foreigners can open a Sdn Bhd new company by paid up capital Ringgit 1 (one). But, foreign banks have condition that paid up/ equity investment of the companies must be Minimum 2000. So, the companies of owning 1 Ringgit will face difficulties to open bank account.

How to register export import companies in Malaysia?

Directly apply for export import license after registering a company in Malaysia along with supporting documents.

Why Can I apply for ESD and work permit in Malaysia?

As guideline of ESD Sdn Bhd company shall be registered through online submission. Some of the conditions are to be eligible as director, CEO and manager of Sdn Bhd companies: 1. Paid up capital of a company shall be 500,000 (100% foreign ownership), 350000 (joint with local partner) 2. Financial and bank statement of 6 months 3. Office tenancy agreement 4. Local authority license (for example Signboard, WRT, Direct selling, CIDB and so on) 5. Office phone bill and WiFi bill copies & 6. SSM CTC copies. Follow ESD application guidelines from government portal.

If ESD registration is successful the company is eligible to apply for work permit following immigration guidelines. ESD registration takes 15-30 days to complete unless any further inquiries by ESD officers.

15-13A, Wisma UOA 2, Jalan Pinang, 50450, Kuala Lumpur, Malaysia.

Scan the code

Limited Liability Company Registration Service Package Ringgit 2500 to RM 3000