Under the new sales tax and service tax framework announced on 16 July 2018, sales tax is levied on the production of taxable goods in Malaysia and the importation of taxable goods into Malaysia at a rate of 5% or 10% or a fixed percentage depending on the category of goods. When any services are sold out SST Malaysia tax is applied that is 6 percent. These are some of the following taxable service that is subjected to service tax (6% flat tax):

Sales and service tax in Malaysia called SST Malaysia. Actually, the tax system is going to replace the existing Good and Service Tax (GST) method. Most commonly known as value added tax. This is imposed on services as well as goods meant for domestic consumption. The new SST was implemented in the country in the 1970s but was abolished. Now, this tax method is going to be re-introduced in the country. This method is a single consumption taxation system and it imposed on goods manufactured in this country, as well as those imported into Malaysia.

What is SST in Malaysia

The tax system is to pass through innovation to make it acceptable to those who want to. Sales tax is to be imposed only on the manufacturer of products while the service tax is to be imposed on the provider of services. This system is to deal with the problem associated with the old order where manufacturers of goods and providers of services, as well as importers, fail to declare their earnings through the usual transfer pricing.

The rates are not yet clear as more explanations are eagerly expected from the government. It is largely expected that sales tax will be based on a ten percent rate while the service tax is to be six percent. As days come by the rate will be clear to the people.

SST stands for sales and services tax. It has been in operation since 1972 in Malaysia and many people believed that it helped in the transformation of the country’s economy over the last decades.

Recently, the system was re-introduced to the country after it was abolished in April, 2015. After a brief introduction of GST in the country, it was eventually replaced with SST. This simply implies a different taxation system which includes sales of goods and products as well as tax or services provided. The charge rate varies. For sales tax, the rate is 10 percent while the rate for services is put at 6 percent.

This tax system is meant for manufacturers of goods and service providers. The law defined those regarded as service providers and manufacturers. These categories of people are expected to register for the taxation process. It is good to identify whether one falls into sales tax category or service tax category.

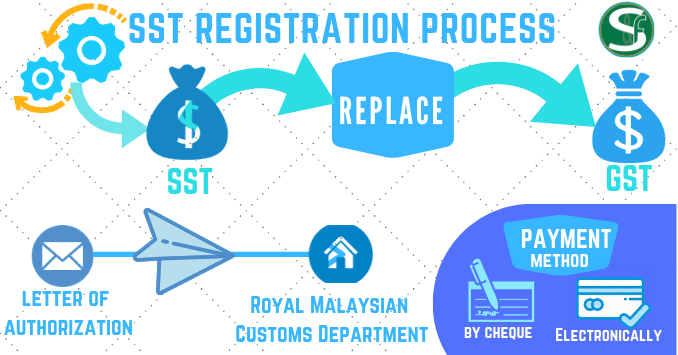

You will be prosecuted if you fail to register your business for taxation process. The charge will begin from September 1, 2018. Even if you were registered under the GST, you need to apply for registration if the system does not capture you as in September. It is mandatory that you apply for registration through the My SST system and you must do that within the thirty days of the commencement of the registration process.

The registration process is automated and it can be done within the next 24 hours. For verification, it could take a longer period than this. There is also provision for voluntary registration. This is open for those providing taxable services and goods.

| GDP | Today stood at 1.60 | Increase by 1.4 in last quarter of 2018 | Another 1.4 in the first quarter of 2019 |

| Unemployment Rate | Currently at 3.30 | Will reduce to 3.2 in the last quarter of 2018. | will it reduces by 3.1 for the rest of 2019 |

| Inflation rate | Current rate stood at 0.30 | Rate could be up in the last quarter of 2018 | Continue with that trend of 1.9 and 1.7 for the rest of 2019. |

| Interest rate | Currently stands at 3.25 | Rate could go up to 3.5 in the whole of 2019 |

Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back. It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry. This new system has already become operational and it was to be in September 2018, which is a few months back.

Since the introduction of the new system, there has been speculation as to how the economy will look like in the end of 2018 and 2019. Already experts are predicting that the economy will grow wonderfully well during the last quarter of 2018 and the first to the last quarter of 2019.

GDP as at today stood at 1.60 and it is expected that it will increase by 1.4 in last quarter of 2018, and by another 1.4 in the first quarter of 2019. The increase will progress by 1.5 in the third quarter and the 1.6 in the last quarter of the same year. It is expected that the GDP will do very well within the period under review.

The unemployment rate is currently at 3.30 and it will reduce to 3.2 in the last quarter of 2018. In the same will it reduces by 3.1 for the rest of 2019. It is expected that many people will be gainfully employed within the period under this review.

Inflation rate stood at 0.30. The rate could be up in the last quarter of 2018 and continue with that trend of 1.9 and 1.7 for the rest of 2019.

Another area of concern is the interest rate. The rate currently stands at 3.25. The rate could go up to 3.5 in the whole of 2019. The other aspects of the economy such as government debt, balance of trade, and so on will appreciate within the next quarter and the whole of 2019. It equally indicates an improvement in the overall government activity.

Government activity !!

When there is an increase in government activity like construction of new projects, it will lead to job creation. More people will have cash at hand because the taxing system will generally bring down the cost of sales and services in the country. It will lead to the quality of life as there will be notable improvement in all key economic sectors.

Continue reading -business license in Malaysia

The new system was introduced after it was criticized for several shortfalls which make it bad for the Malaysian economy. It is assumed that it is inflicting hardship on people by pushing up the cost of goods and services. Middlemen are the beneficiary,because they have taken the opportunity to hike the cost of goods to the detriment of the masses who want reduction

in prices of goods.

It is not even good for business because collection of such taxes are difficult. Businesses often decline and before it can be claimed it requires RM500k as volume of sales made before the tax can be claimed.

Malaysia was relying on a workable taxing system for decades and this has been helping the economy without relying on GST. For many people, there is no need to change an effective system with another system that is not working for the economy.

Those goods that were exempted under GST were not necessities to the economy, rather they were expensive items. The government believed that this new method is good for the economy.

Although there are lots of criticism for GST, many people still believe that it is more progressive than the SST. Most countries in the world that were implementing SST are now moving to GST for the obvious reasons.

The government believes that GST is making things difficult for people because it increases taxation and the cost of goods and services. There is the assumption that more money will be collected on SST as against GST. Currently, government put SST at 10 percent, which is more than 6 percent for GST.

Some experts believe that more tax may not be collected under the new method. It may seem that 6 percent is lower than 10 percent, but in reality more money will come from GST, because not all sales and services are taxed under the SST.

Government equally assumed that GST can lead to double taxation as items are taxed severally and compounded. It appears that the general opinion of the public is that hardship is associated with GST. It can soar the prices of goods and services and the country does not benefit from more money coming for the goods and services. However, the major concern is that government should put confidence on the mind of investors. Incessant changes in the tax system can send negative signals, which is not good for the economy.

Government claims that the new system will help because it can facilitate planning. It can streamline expenditure as well as bring about reduction in unnecessary spending. Moreover, it can help revamp the economy and restructure the revenue system. The government believes that the money so realized will be used for the benefit of the public.

Conclusion

Above I have explained how Sales and service tax in Malaysia works. I have also discussed how SST will replace GST text method. Moreover, I have also discussed about SST registration process. Under the new sales tax and service tax framework the sales tax is chargeable only on the manufacture of taxable goods in Malaysia at a rate of 5 percent or 10 percent. You may want to know about setting up a small business in Malaysia.

Frequently Asked Question

When did sales and service tax implemented in Malaysia ?

Sales and service tax is implemented in Malaysia from September 1, 2018

What is the standard rate of VAT in Malaysia?

Th standard rate of VAT in Malaysia is 6%.

When Should a company need to declare SST return ?

Every company in Malaysia need to declare SST return every 2 month according to the taxable period

What is sales tax rate in Malaysia ?

The sales tax rates depend on the type of good that is imported. Usually the sales tax rates ranges from 5% to 10 %.